Och det gör det verkligen hemma hos oss. Sedan vi var små så har både mamma och pappa spelat och dansat och sjungit till både radio, LP-skivor, cd-skivor så att det bara hoppar musiknoter urContinue reading

Fuktskydd

Många är vi som någon gång kommer att få problem med fukt någonstans i huset eller byggnaden. Det hör inte direkt till ovanligheten att det bildas mögel och fukt i huskroppar, det kan vara iContinue reading

Skaffa städhjälp?

Jag funderar starkt på att skaffa städhjälp. För nu är jag så himla trött på det eviga städandet varje fredag efter jobbet. När man kommer hem och är trött och sliten efter en veckas hårtContinue reading

Drömmer du om att flytta till huvudstaden?

Ja är du i tankarna om att flytta till Sveriges framsida, vår konungs hemstad, vårt allas Stockholm? Jag förstår då att du kanske tror att det är omöjligt att hitta en hyresrätt. För det kanContinue reading

Mannen med eldkastare på taket

Ser att det är ett par gubbar uppe på fastigheten i andra änden av vår gata. Eftersom jag ser en man stå med en mindre eldkastare riktad mot taket så tror jag att de hållerContinue reading

Kablar ut media via fiberkablar

Danmark är trevligt resmål och även nära att resa till om du bor i Sverige. Jag bor i Helsingborg som är några minuter bort från den Danska gränsen. VI brukade ofta åka över till HelsingörContinue reading

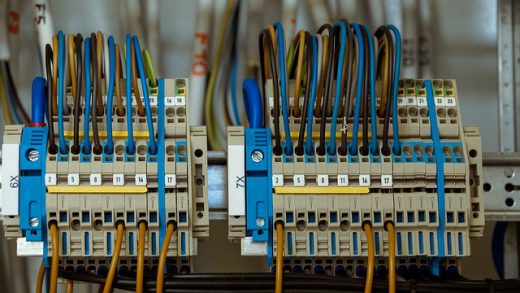

Ett elföretag för dig!

Nordins El AB är bosatt i Östersund och har funnits i snart 50 år tillbaka i tiden. Engagemang, omtanke och kvalité genomsyrar företaget med ett 25-tal anställda som dagligen utför service av både nyinstallation avContinue reading

Letar efter nån som kan installera solpaneler

Vi har bestämt oss för att satsa på solenergi som en av våra elkällor. Men nu gäller det att hitta ett företag som kan hjälpa oss med installationen. Inte det lättaste tycker jag. Jag harContinue reading

I Sommarsverige kan man inte ha nog med golvfläktar

Jag minns än sommaren för tre år sedan när det var så otroligt varmt under sommaren. Alla svenskar satt och svettades och alla butiker hade slutsålt när det kom till fläktar. Vis av de erfarenheternaContinue reading

Vad gör man när fukt och mögel fått fäste i syllarna? Syllbyte är enda hållbara lösningen

Man kan ha ett 150 år gammalt hus som aldrig har problem och man kan ha ett 40–50 år gammalt hus där problemen hopar sig. Ofta beror det på hur huset byggdes och hur braContinue reading